BHPH Startup Capital and Reserves: A Risk-Ready Budget Model (5/10/15% Charge-Off Scenarios)

Most BHPH dealership failures are cash-flow failures. This guide provides a conservative budget model that forces dealers to plan for reserves, reconditioning, and charge-off volatility across multiple scenarios.

In the challenging, yet rewarding, world of Buy-Here Pay-Here (BHPH) dealerships, a robust financial foundation is not merely a recommendation—it's the bedrock of survival. The harsh reality is that a significant number of BHPH failures stem not from poor sales, but from inadequate cash flow planning and a lack of sufficient reserves. For a complete blueprint on launching a resilient BHPH venture, refer to our comprehensive pillar post: "Launching a Buy Here Pay Here Dealership: Complete Blueprint". This article presents a conservative, risk-ready budget model designed to inoculate your dealership against the unpredictable nature of charge-offs, ensuring you proactively plan for necessary reserves, reconditioning costs, and the inherent volatility of a BHPH portfolio.

The Problem: Unpreparedness for Cash-Flow Volatility in BHPH

The unique operational model of Buy-Here Pay-Here (BHPH) dealerships inherently carries a higher degree of cash-flow volatility compared to traditional retail. Unlike a conventional dealership that sells a car and immediately receives full payment (or a financed amount from a third-party lender), BHPH operators extend credit in-house, making them directly responsible for the entire loan lifecycle. Many new and even some established BHPH dealers underestimate the working capital demands and financial risks involved, leading to:

- Insufficient Reserves: A common oversight is failing to adequately budget for future charge-offs, repossessions, and reconditioning expenses, leaving the dealership vulnerable to market fluctuations or unexpected events.

- Cash-Flow Crunch: Without meticulous planning for the timing of working capital, especially in the crucial initial months, dealerships can face liquidity crises even with strong sales.

- Underestimated Reconditioning Costs: The reality of managing an inventory that must perform through its financed life (and potentially beyond) means significant, ongoing reconditioning investments that are often not fully accounted for.

- Reactive Decision-Making: A lack of a "risk-ready" budget forces dealers into reactive decisions, such as selling performing notes prematurely or cutting corners on reconditioning, which can damage long-term profitability.

- Lender/Investor Skepticism: External funders require confidence in a dealership's financial planning and risk management. An ill-prepared budget signals instability.

These challenges highlight why generic budgeting approaches simply don't suffice for the specialized demands of a BHPH operation.

The Solution: A Risk-Ready BHPH Budget Model

The solution to mitigating BHPH's inherent cash-flow risks lies in adopting a robust, conservative budget model that explicitly plans for volatility, reserves, and potential charge-off scenarios. This "risk-ready" approach moves beyond simple revenue projections to a detailed financial framework that builds resilience into your operation from day one. By proactively modeling for various charge-off rates and their impact on liquidity, dealerships can secure the necessary capital and reserves to withstand market pressures and unexpected events.

A meticulously crafted budget model empowers BHPH dealers with foresight. It transforms uncertainty into calculated risk, allowing for strategic planning around inventory acquisition, reconditioning investments, and portfolio management. This proactive financial strategy not only safeguards against common pitfalls but also positions the dealership for sustainable growth, attracting confident investors and fostering long-term stability in the dynamic BHPH market. For a deeper understanding of BHPH financing fundamentals, consider reviewing our comprehensive guide: Buy Here Pay Here (BHPH) Financing.

Key Benefits of a Risk-Ready BHPH Budget Model

Implementing a risk-ready budget model is foundational for any successful BHPH operation, offering numerous critical benefits:

- Enhanced Financial Stability: Proactive planning for charge-offs and reconditioning costs ensures your dealership has the necessary capital reserves to weather market fluctuations and unexpected events.

- Minimized Cash-Flow Crises: A detailed understanding of working capital timing and needs prevents liquidity shortfalls, allowing for smooth day-to-day operations and strategic investments.

- Optimized Reconditioning Investments: By explicitly budgeting for reconditioning, you ensure vehicles are properly maintained throughout their financed life, reducing future defaults and preserving asset value.

- Informed Decision-Making: Scenario planning for different charge-off rates empowers you to make data-driven decisions on deal terms, approvals, and portfolio management, balancing risk and profitability. For more insights into tracking these critical metrics, explore our guide on BHPH Portfolio KPIs and Dashboards.

- Increased Investor Confidence: A transparent, conservative budget model demonstrates strong financial stewardship, making your dealership more attractive to lenders and investors seeking stable partnerships.

- Sustainable Growth: Building resilience into your financial structure allows you to confidently scale operations, knowing you have the buffers in place to absorb growth-related challenges.

- Reduced Stress and Uncertainty: Proactive financial planning eliminates much of the guesswork and anxiety associated with BHPH operations, allowing you to focus on strategic execution.

How It Works: Building Your Risk-Ready BHPH Budget Model

Constructing a truly risk-ready BHPH budget model involves a detailed breakdown of costs, meticulous reserve planning, and proactive scenario analysis.

1. Why BHPH Budget Planning Is Different from Retail Used Car

Traditional retail budgeting often focuses on inventory turns and gross profit per unit. BHPH budgeting must account for the entire lifecycle of the loan, including collections, repossessions, reconditioning, and potential losses. It's an ongoing revenue stream with deferred costs and risks.

2. The “True” Startup Cost Categories

Beyond the obvious, ensure you budget for these essential components:

- Lot + Renovations: Not just purchase/lease, but also necessary upgrades for security, customer experience, and compliance.

- Legal/Compliance: Attorney fees for contract review, licensing applications, and ongoing regulatory guidance.

- Software + Payment Tooling: A robust Dealer Management System (DMS) like DealerClick and integrated payment processing solutions are non-negotiable for efficiency and compliance.

- Initial Inventory + Reconditioning: Beyond the purchase price, budget for thorough reconditioning to ensure vehicles are reliable and meet quality standards.

- Staff + Training: Salaries, benefits, and ongoing training for sales, underwriting, collections, and service teams.

- Marketing + Lead Handling: Initial marketing efforts, website development, and tools for lead management.

3. Reserve Planning: Why It Must Be Explicit

Your reserves are your operational safety net.

- Charge-Off Buffer: Capital specifically set aside to cover expected and unexpected loan losses.

- Reconditioning Fund: Dedicated funds for post-repossession reconditioning or major repairs during the loan term.

- Working Capital Buffer: Funds to cover operational expenses during periods of lower collections or slower sales.

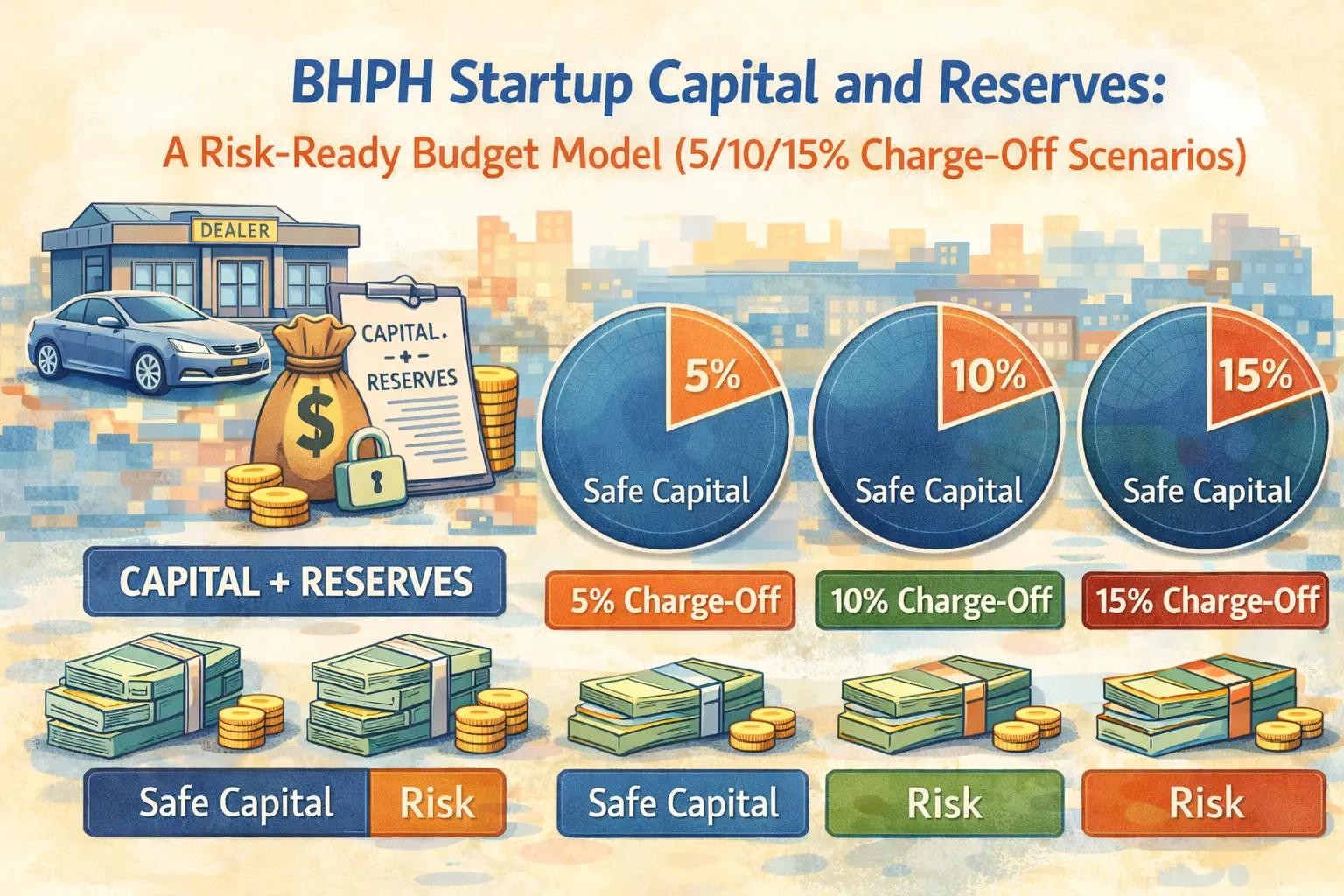

4. Scenario Model: 5%, 10%, 15% Charge-Offs

Proactively model how different charge-off rates impact your cash flow and required reserves.

- What Changes in Terms, Approvals, and Cash Needs:

- At a 5% charge-off rate, you might approve more deals with slightly lower down payments.

- At 10%, you might tighten underwriting, demand higher down payments, or shorten terms.

- At 15%, you'd need significantly higher reserves, stricter underwriting, and robust collections to maintain liquidity.

- Impact on Profitability: Analyze how each scenario affects your net profit and break-even points.

Example: Charge-Off Scenario Impact on Reserves

Below is a conceptual graph illustrating how increasing charge-off rates directly correlate with the need for higher capital reserves to maintain dealership solvency. (Note: In a live blog, this would be a dynamic or static infographic, showing different bars for required reserves at 5%, 10%, 15% charge-off rates based on a hypothetical portfolio size.)

5. Working Capital Timing: The First 90–180 Days

BHPH is a long-term game; upfront cash is king.

- Inventory Acquisition: Cash needed to purchase initial inventory.

- Reconditioning Cycle: Funds required to make vehicles sale-ready before they generate income.

- Collections Lag: The time between selling a vehicle and establishing a consistent payment stream. Your first few months will have high outflows and lower inflows.

6. Funding Options Overview

Explore various avenues to secure your startup and reserve capital:

- SBA Loans: Government-backed loans often with favorable terms.

- Credit Lines: Revolving lines of credit for operational flexibility.

- Investors/Partners: Equity or debt financing from private individuals or groups.

- Internal Capital: Self-funding or reinvesting profits from other ventures.

7. What Lenders/Investors Want to See in Your Model

Present a professional, data-driven financial plan:

- Conservative Projections: Show realistic, not overly optimistic, revenue and collections forecasts.

- Detailed Expense Breakdown: Demonstrate a clear understanding of all operational costs.

- Robust Risk Management: Highlight your reserve planning and charge-off scenarios.

How DealerClick Supports: Portfolio Reporting and KPI Visibility

DealerClick provides critical tools for managing your BHPH finances with precision. Our comprehensive portfolio reporting and KPI visibility features allow you to track collections, monitor delinquency rates, and analyze charge-off performance in real-time. This data is invaluable for accurately forecasting cash flow, managing reserves, and demonstrating financial discipline to investors. With DealerClick’s Buy Here Pay Here Dealer Software, you gain the financial insights needed to build a resilient and profitable dealership. For a deeper understanding of BHPH financial dynamics, you may also refer to our article on BHPH Financing. If a strategic shift in book management is ever considered, our /services/portfolio-selling/ offerings can provide guidance.

Conclusion: Building a Resilient BHPH Dealership with Financial Foresight

The success of a Buy-Here Pay-Here dealership is inextricably linked to its financial planning and the robustness of its capital and reserves. By adopting a risk-ready budget model that explicitly accounts for reconditioning, working capital timing, and various charge-off scenarios, dealers can transform potential vulnerabilities into pillars of strength. This proactive approach not only safeguards against the inherent cash-flow volatility of BHPH but also lays a clear path for sustainable growth and increased investor confidence.

Embrace financial foresight as your most powerful asset. With meticulous planning and the right tools to monitor your portfolio, your BHPH dealership can navigate market challenges, optimize profitability, and build a lasting legacy of success.

Ready to build a risk-ready financial model for your BHPH dealership?

Frequently Asked Questions (FAQs)

Why is budgeting for BHPH different from a traditional used car dealership?

BHPH budgeting is distinct because the dealer acts as the lender, retaining the loan risk and managing collections in-house. This requires budgeting for future charge-offs, repossessions, reconditioning costs, and maintaining significant working capital reserves to cover operational expenses during the loan lifecycle, unlike a traditional dealership that receives immediate payment from third-party financing.

What are "reserves" in BHPH and why are they crucial?

In BHPH, reserves are dedicated funds set aside to cover anticipated and unanticipated financial needs, such as loan losses (charge-offs), reconditioning costs for repossessed vehicles, and operating expenses during periods of fluctuating cash flow. They are crucial because they provide a financial buffer, ensuring the dealership's liquidity and stability against the inherent risks of extending in-house credit.

How do charge-off scenarios (5/10/15%) help in BHPH financial planning?

Modeling different charge-off scenarios (e.g., 5%, 10%, 15%) allows BHPH dealers to stress-test their financial plan. It helps them understand how varying rates of loan loss would impact their required capital, cash flow, and profitability. This proactive analysis enables them to set more realistic underwriting standards, adjust deal terms, and ensure adequate reserves are maintained for different risk environments.

What is "working capital timing" and why is it important in BHPH?

Working capital timing refers to understanding the flow of cash in and out of the BHPH business, particularly the lag between initial investments (inventory acquisition, reconditioning) and the consistent inflow of payments. It's crucial because BHPH is cash-intensive upfront, and proper planning ensures the dealership has enough liquidity to cover expenses and sustain operations before its portfolio generates sufficient recurring revenue.

How can DealerClick assist with BHPH financial planning and reserve management?

DealerClick's comprehensive portfolio reporting and KPI visibility features provide real-time data on collections, delinquency rates, and charge-off performance. This enables dealers to accurately forecast cash flow, manage reserves effectively, and conduct detailed scenario planning. Its tools empower dealers to maintain financial discipline and demonstrate a solid business model to potential lenders or investors.

Stay Updated

Get the latest auto dealer insights delivered straight to your inbox.

No spam. Unsubscribe anytime.