Repossession and Recovery Workflow for BHPH: From Delinquency to Remarketing (Without Losing Control)

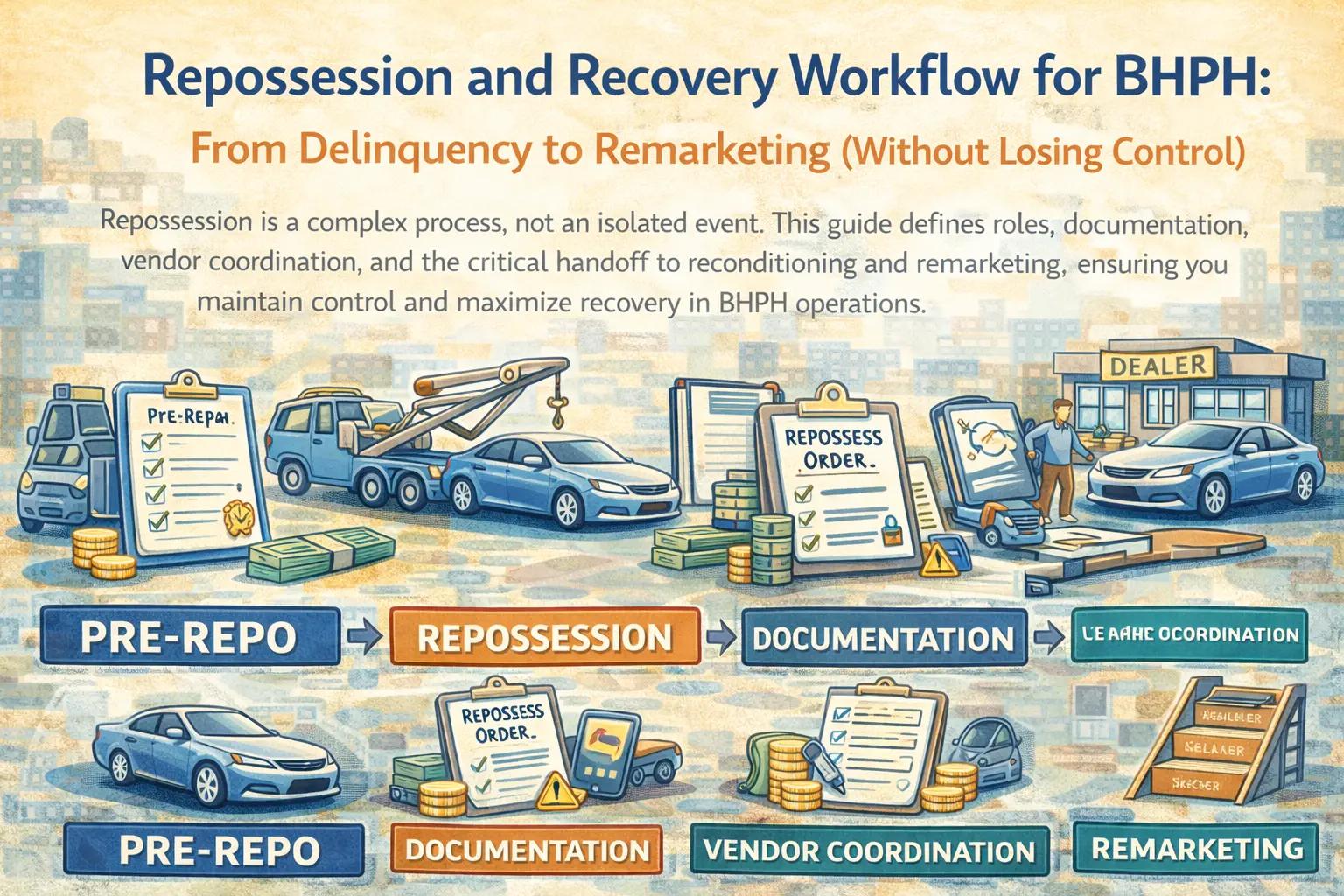

Repossession is a complex process, not an isolated event. This guide defines roles, documentation, vendor coordination, and the critical handoff to reconditioning and remarketing, ensuring you maintain control and maximize recovery in BHPH operations.

In the challenging landscape of Buy-Here Pay-Here (BHPH) dealerships, the decision to repossess a vehicle is never taken lightly. It signifies a breakdown in the collections process and initiates a complex, multi-stage workflow from delinquency to potential remarketing. Without a meticulously defined and rigorously followed procedure, this critical phase can quickly become chaotic, leading to significant financial losses and compliance risks. For a complete blueprint on launching a successful BHPH operation, including foundational insights into every operational aspect, refer to our pillar post: "Launching a Buy Here Pay Here Dealership: Complete Blueprint". This article outlines a comprehensive repossession and recovery workflow for BHPH, detailing clear roles, essential documentation, effective vendor coordination, and the crucial handoff to reconditioning and remarketing—all designed to help you maintain control and maximize recovery value.

The Problem: Haphazard Repossession Management Leads to Avoidable Losses

For many Buy-Here Pay-Here (BHPH) dealerships, repossession is often viewed as a singular, unfortunate event rather than a structured process. This reactive and uncoordinated approach to managing asset recovery can lead to a cascade of problems that significantly erode profitability and introduce compliance vulnerabilities:

- Increased Financial Losses: Without a clear workflow, vehicles may sit idle, accumulate storage fees, or incur unnecessary damage, all of which diminish their recovery value. Poor reconditioning and remarketing decisions further exacerbate these losses.

- Compliance Risks: Repossession is a highly regulated activity. Inadequate documentation, inconsistent adherence to state laws (e.g., proper notices, handling of personal property), or untrained staff can lead to costly fines and legal action.

- Operational Inefficiency: A lack of defined roles and handoffs between collections, repossession agents, and remarketing teams creates bottlenecks, delays, and wasted resources.

- Poor Vendor Performance: Without clear expectations and oversight, external vendors (repo agents, auctions) may not perform optimally, impacting recovery times and costs.

- Inaccurate Loss Tracking: Haphazard processes make it difficult to accurately track the true cost of each repossession, hindering data-driven decisions for future underwriting and collections strategies.

These challenges underscore the absolute necessity of a well-defined and repeatable repossession and recovery workflow for sustainable BHPH success.

The Solution: A Structured Repossession and Recovery Workflow

The solution to mitigating losses and maintaining control in BHPH repossession is to implement a structured, end-to-end workflow from the moment an account becomes "repo-eligible" through to reconditioning and remarketing. This comprehensive approach emphasizes clear policies, meticulous documentation, expert vendor management, and seamless inter-departmental handoffs. By transforming repossession from an unpredictable event into a disciplined process, dealerships can ensure compliance, optimize asset recovery, and minimize financial impact.

A well-defined repossession and recovery workflow safeguards your dealership against legal risks, streamlines operations, and maximizes the recovered value of assets. It empowers your team with clear guidelines for every step, fostering efficiency and accountability. This proactive strategy not only protects your profitability but also provides valuable data for refining future underwriting and collections efforts, turning lessons from losses into drivers of improved portfolio performance.

Key Benefits of a Structured BHPH Repossession Workflow

Implementing a structured repossession and recovery workflow offers critical advantages for your BHPH dealership:

- Maximized Recovery Value: Defined processes for asset recovery, inspection, and timely reconditioning ensure vehicles are quickly prepared for remarketing, reducing depreciation and maximizing their resale potential.

- Reduced Financial Losses: Meticulous tracking of all costs associated with repossession, reconditioning, and remarketing allows for accurate loss assessment and better financial planning.

- Enhanced Compliance & Risk Mitigation: Clear policies and documentation ensure adherence to all state and federal regulations, significantly reducing exposure to fines, legal challenges, and consumer complaints.

- Streamlined Operations: Defined roles, checklists, and vendor management protocols eliminate guesswork, improve efficiency, and accelerate the entire recovery-to-remarketing cycle.

- Improved Vendor Performance: Clear communication of expectations and performance monitoring of repossession agents, auctions, and transporters lead to better service and cost control.

- Better Data for Underwriting & Collections: Accurate loss tracking and recovery metrics provide invaluable feedback for refining your underwriting scorecards and collections strategies, improving future portfolio performance.

- Consistency Across the Board: A standardized workflow ensures every repossession is handled with the same level of professionalism and diligence, regardless of the account or agent involved.

How It Works: Your BHPH Repossession and Recovery Playbook

Executing a disciplined repossession and recovery workflow requires systematic planning and meticulous attention to detail.

1. Deciding When a File Becomes “Repo-Eligible” (Policy-Based Triggers)

Repossession should be a policy-driven decision, not an emotional one.

- Clear Triggers: Define specific delinquency thresholds (e.g., 60 days past due), communication failures, or other breaches of contract that automatically trigger a review for repossession.

- Manager Approval: Implement a mandatory manager review and approval process before initiating repossession, ensuring all policy criteria are met.

2. Pre-Repo Checklist: Documentation, Approvals, Compliance Steps

Before an agent is dispatched, a thorough internal checklist is crucial.

- Verify Documentation: Ensure all loan documents, titles, and legal notices are complete and readily accessible.

- Confirm Compliance: Check that all required default notices have been sent to the customer within legal timeframes.

- Locate Vehicle: Utilize available tools (e.g., GPS tracking, skip tracing) to confirm the vehicle's last known location. For best practices on using these devices, refer to our guide on GPS and Starter Interrupt in BHPH.

3. Vendor Management

Effective partnerships are key to an efficient process.

- Repossession Agents: Establish clear service level agreements (SLAs), fee structures, and communication protocols. Ensure they are licensed and insured.

- Auctions: Select reputable auction houses with a track record of strong recovery values. Understand their fee structures and sales cycles.

- Transport and Storage: Coordinate efficient transport from the point of recovery to your lot or the auction, and manage storage costs effectively.

4. Asset Recovery Workflow

From vehicle intake to assessing its condition.

- Intake Inspection: Conduct a detailed inspection of the recovered vehicle immediately upon its return to your lot or agent. Document all damage, mileage, and condition with photos and notes.

- Personal Property Handling (Policy-Driven): Meticulously document, inventory, and store any personal property found in the vehicle, adhering strictly to state laws and your own clear policy for customer retrieval.

- Reconditioning Assessment: Immediately assess the vehicle for necessary reconditioning. Prioritize repairs based on remarketing strategy (retail vs. wholesale).

Example: Repossession & Recovery Workflow Timeline

Below is a conceptual graph illustrating the typical timeline and key stages in a BHPH repossession and recovery workflow. (Note: In a live blog, this would be a dynamic or static infographic, showing a timeline from delinquency trigger to remarketing, with average days for each step and associated compliance checkpoints.)

5. Remarketing Decision Tree

Make data-driven decisions about the vehicle's next life.

- Retail Again vs. Wholesale vs. Auction: Based on reconditioning costs, market demand, and the vehicle's condition, decide whether to recondition for retail sale on your lot, sell to a wholesaler, or send to auction.

- Cost-Benefit Analysis: Perform a quick analysis for each option to maximize net recovery.

6. Loss Tracking: Deficiency and Recovery Metrics

Accurately track all financial impacts.

- Deficiency Balances: Document the remaining balance on the loan after recovery and sale proceeds.

- Recovery Metrics: Track the percentage of original loan balance recovered, and the time-to-recovery (from repo trigger to final sale).

How DealerClick Supports Repo Status, Recovery Notes, and Reporting

DealerClick provides an integrated platform designed to manage the complexities of BHPH repossession and recovery. Our system allows you to track repo-eligible accounts, log pre-repo checklists, manage vendor communications, and document every step of the asset recovery workflow. With robust reporting, you can monitor recovery times, track costs, and gain insights into loss tracking and remarketing decisions, all within our Buy Here Pay Here Dealer Software. This ensures you maintain control from delinquency to remarketing, maximizing your recovery value.

Conclusion: Mastering the Repossession Process for BHPH Resilience

In the BHPH world, repossession is an unfortunate but sometimes necessary part of managing risk. However, it doesn't have to lead to unmanaged losses. By implementing a structured, policy-driven repossession and recovery workflow—encompassing clear triggers, meticulous documentation, vendor coordination, and strategic remarketing—dealerships can regain control, ensure compliance, and maximize asset recovery value. This proactive approach transforms a challenging event into a streamlined process that contributes valuable insights back into your underwriting and collections strategies.

Embrace a comprehensive repossession playbook as a key component of your BHPH operational resilience. With a disciplined approach and integrated tools, your dealership can navigate the entire delinquency-to-remarketing cycle with confidence, protecting your assets and optimizing your long-term profitability.

Ready to gain control over your BHPH repossession and recovery workflow?

Frequently Asked Questions (FAQs)

What triggers a vehicle to become "repo-eligible" in BHPH?

Repo-eligibility is typically triggered by predefined policy criteria, such as a specific number of days past due (e.g., 60-90 days), a sustained lack of communication from the customer, repeated broken promises to pay, or other significant breaches of the loan contract. These triggers should be clearly documented and consistently applied.

What documentation is critical before initiating a BHPH repossession?

Before initiating repossession, critical documentation includes the original loan agreement, proof that all required default notices were sent to the customer within legal timeframes, clear identification of the vehicle, and any recent communication attempts. Meticulous documentation is essential for compliance and to protect the dealership legally.

How should personal property found in a repossessed vehicle be handled?

Handling personal property in a repossessed vehicle is highly regulated and must follow strict state laws. Dealers must inventory all items, store them securely, and provide proper notice to the customer for retrieval within a specified timeframe. Failure to adhere to these rules can lead to legal penalties.

What is a "remarketing decision tree" in BHPH recovery?

A remarketing decision tree is a structured process to determine the best course of action for a recovered vehicle. It involves evaluating factors like the vehicle's condition, reconditioning costs, market demand, and outstanding loan balance to decide whether to recondition it for retail sale on the lot, sell it to a wholesaler, or send it to auction, all with the goal of maximizing net recovery.

How can DealerClick assist with BHPH repossession tracking and reporting?

DealerClick provides integrated tools to track repo-eligible accounts, log pre-repossession checklists and documentation, and manage vendor communications. It offers robust reporting on recovery times, costs, and remarketing outcomes, allowing BHPH dealers to gain real-time insights into the efficiency and profitability of their repossession and recovery workflow.

Stay Updated

Get the latest auto dealer insights delivered straight to your inbox.

No spam. Unsubscribe anytime.