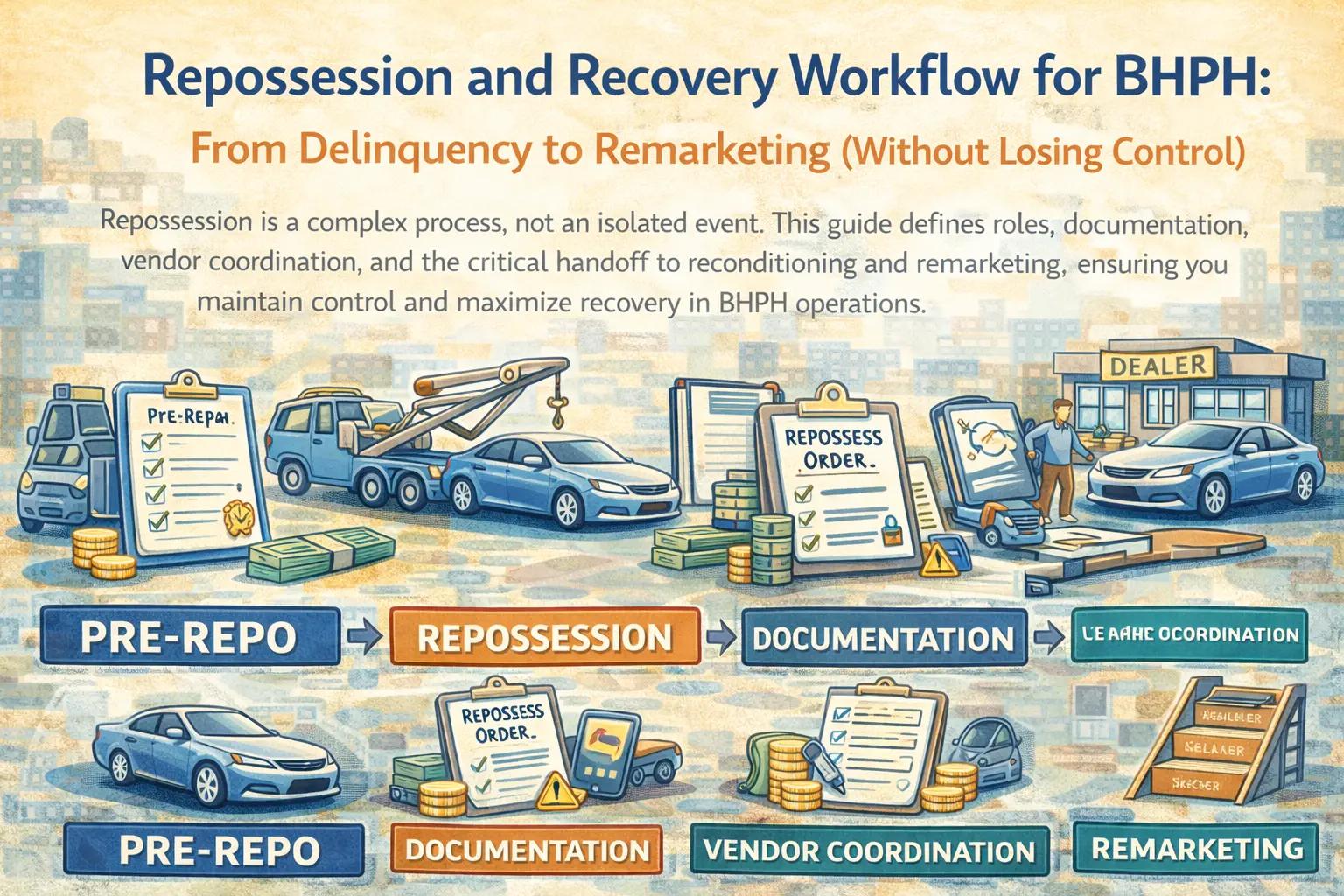

BHPH Collections SOP: Scripts, Cadence, Hardship Programs, and Escalation Ladders

Collections outcomes improve dramatically when your BHPH team operates with a defined cadence, clear scripts, and well-structured hardship programs—intervening effectively before delinquency spirals into a repossession decision.

In the challenging world of Buy-Here Pay-Here (BHPH) dealerships, effective collections are not merely a function; they are the lifeblood of the business. Without a structured, proactive approach, delinquency can quickly spiral out of control, eroding profitability and leading to costly repossessions. For a complete blueprint on launching a successful BHPH operation, including foundational insights into every operational aspect, refer to our pillar post: "Launching a Buy Here Pay Here Dealership: Complete Blueprint". This article provides a comprehensive Standard Operating Procedure (SOP) for BHPH collections, detailing the development of clear scripts, a defined communication cadence, strategic hardship programs, and robust escalation ladders, all designed to intervene effectively long before delinquency necessitates a repossession decision.

The Problem: Reactive and Inconsistent Collections Undermine BHPH Profitability

Many BHPH dealerships struggle with collections, often due to a reactive and inconsistent approach. Lacking a defined Standard Operating Procedure (SOP), collections efforts can become chaotic, leading to:

- Escalating Delinquency: Without a proactive cadence, small missed payments quickly become large, unmanageable balances, increasing the likelihood of charge-offs and repossessions.

- Inefficient Staff Time: Haphazard collections consume excessive staff hours, with agents reinventing the wheel for each interaction, leading to burnout and lower productivity.

- Customer Frustration and Churn: Inconsistent communication, aggressive tactics, or a lack of structured hardship options can alienate customers, damaging relationships and driving them away.

- Compliance Risks: Without standardized scripts and documented procedures, collections calls can unintentionally violate consumer protection laws, leading to fines and legal action.

- Cash-Flow Instability: Unpredictable collections performance makes cash flow forecasting difficult, jeopardizing the dealership’s financial stability.

- Lost Opportunities: Without hardship programs, potentially salvageable accounts default, costing the dealership the value of the vehicle and the relationship.

These issues highlight why a disciplined, systematic approach to BHPH collections is not just beneficial, but absolutely essential for long-term profitability and risk management.

The Solution: A Structured BHPH Collections SOP for Proactive Engagement

The solution to mitigating high delinquency and collections inefficiencies in BHPH lies in implementing a comprehensive, well-defined Collections Standard Operating Procedure (SOP). This SOP serves as a clear roadmap for your collections team, outlining precise scripts, a strategic communication cadence, well-structured hardship programs, and clear escalation ladders. By transforming reactive collections into proactive engagement, dealerships can effectively intervene before delinquency spirals, preserving customer relationships and maximizing portfolio value.

A structured Collections SOP ensures consistency across all interactions, reduces compliance risks, and empowers collection agents with the tools and guidelines needed to succeed. It optimizes resource allocation by defining when to automate and when to personalize, ultimately leading to improved cure rates, stabilized cash flow, and a more resilient BHPH portfolio. This disciplined approach shifts the focus from chasing payments to managing customer relationships and mitigating risk.

Key Benefits of a Structured BHPH Collections SOP

Implementing a well-defined Collections SOP offers a multitude of advantages for your BHPH dealership:

- Improved Cure Rates: A proactive, systematic approach with timely reminders and early intervention strategies significantly increases the likelihood of bringing delinquent accounts current.

- Reduced Delinquency & Charge-Offs: Consistent cadence and effective communication help prevent minor payment issues from escalating into major delinquencies and costly charge-offs.

- Enhanced Cash Flow Predictability: Stabilized collections performance leads to more consistent and predictable cash flow, enabling better financial planning and operational stability.

- Increased Operational Efficiency: Standardized scripts and clear procedures reduce guesswork, streamline collections activities, and free up staff time for higher-value tasks.

- Mitigated Compliance Risk: Documented scripts and adherence to an SOP ensure collections practices comply with consumer protection laws, reducing exposure to fines and legal action.

- Better Customer Retention: Offering structured hardship programs and consistent, empathetic communication helps preserve customer relationships, fostering loyalty and future business.

- Empowered Collections Team: Clear guidelines, scripts, and escalation paths build confidence and competence within your collections team, leading to improved performance and job satisfaction.

- Optimized Resource Allocation: By defining when to automate and when to intervene personally, your resources are used most effectively, maximizing returns on your collections efforts.

How It Works: Building Your BHPH Collections SOP

A successful BHPH Collections SOP is built on principles of speed, consistency, clear communication, and strategic intervention.

1. The Collections Principle: Speed + Consistency Beats Intensity

Effective collections prioritize early, consistent contact over aggressive, sporadic attempts. The sooner you identify a missed payment and engage the customer, the higher the likelihood of resolution.

2. Building Your Cadence

A defined timeline for contact and action ensures no account falls through the cracks.

- Day 0–3: Reminders and Friction Removal: Automated SMS, email, or in-app notifications immediately following a missed payment. Offer easy ways to pay (online portal, phone).

- Day 4–10: Early Outreach and Resolution Offers: First personal contact (call/email/SMS) to understand the situation. Offer solutions like payment arrangements or short-term deferrals for valid hardship cases.

- Day 11–30: Escalation Ladder: Increase contact frequency. Begin formal notices. Explore longer-term hardship programs.

3. Scripts That Reduce Conflict (Call/SMS/Email Templates)

Standardized communication ensures consistency, compliance, and effective conflict resolution.

- Opening: Empathetic, problem-solving tone. "I'm calling about your recent payment. How can I help resolve this?"

- Information Gathering: "What's preventing you from making this payment today?"

- Solution Offering: "We have options to help, such as a temporary payment plan. Would you like to discuss that?"

- Closing: Clear next steps and agreement.

- Compliance Language: Ensure all scripts include necessary disclosures and avoid prohibited language.

4. Promise-to-Pay Tracking and Follow-Up Rules

Meticulously track all promises and ensure follow-up.

- System Documentation: Log every promise-to-pay (date, amount, method) in your DMS.

- Automated Reminders: Set up automated reminders for both the customer and the collections agent for the promised date.

- Immediate Follow-Up: If a promise is broken, initiate immediate follow-up according to your escalation ladder.

5. Hardship Programs

Offer structured programs to help customers through temporary difficulties.

- When to Offer: Define clear criteria for offering hardship programs (e.g., job loss, medical emergency).

- How to Document: Ensure all hardship agreements are clearly documented, signed, and updated in the customer's file.

- How to Avoid Policy Drift: Train staff rigorously on policy details and regularly audit hardship approvals to maintain consistency.

Example: Collections Escalation Cadence with Cure Rates

Below is a conceptual graph illustrating how a structured collections cadence can impact cure rates at different stages of delinquency. (Note: In a live blog, this would be a dynamic or static infographic, showing a flow chart or timeline with contact points and associated cure rate percentages.)

6. Team Roles: Who Owns What Stage

Clearly define responsibilities within the collections department.

- Early-Stage Agents: Focus on initial reminders and resolving minor payment issues.

- Advanced Collections/Loss Mitigation: Handle more complex delinquencies, hardship programs, and pre-repossession efforts.

7. Reporting: Buckets, Roll Rates, Cure Rates

Regularly monitor key collections metrics to identify trends and adjust your SOP.

- Delinquency Buckets: Track accounts in 1-7 days past due, 8-15, 16-30, 31-60, 61-90+.

- Roll Rates: Percentage of accounts rolling from one delinquency bucket to the next. High roll rates indicate ineffective early collections.

- Cure Rates: Percentage of delinquent accounts that become current within a specific timeframe.

How DealerClick Supports Reminders, Notes, and Status Visibility

DealerClick provides an integrated platform that empowers BHPH dealerships to execute a disciplined collections SOP. Our system automates payment reminders and notifications, enables seamless logging of all customer communications and promise-to-pays, and provides real-time status visibility for every account. With customizable scripts and integrated workflow management, DealerClick’s Buy Here Pay Here Dealer Software streamlines your collections process, improves cure rates, and helps you effectively manage delinquencies before they lead to repossessions.

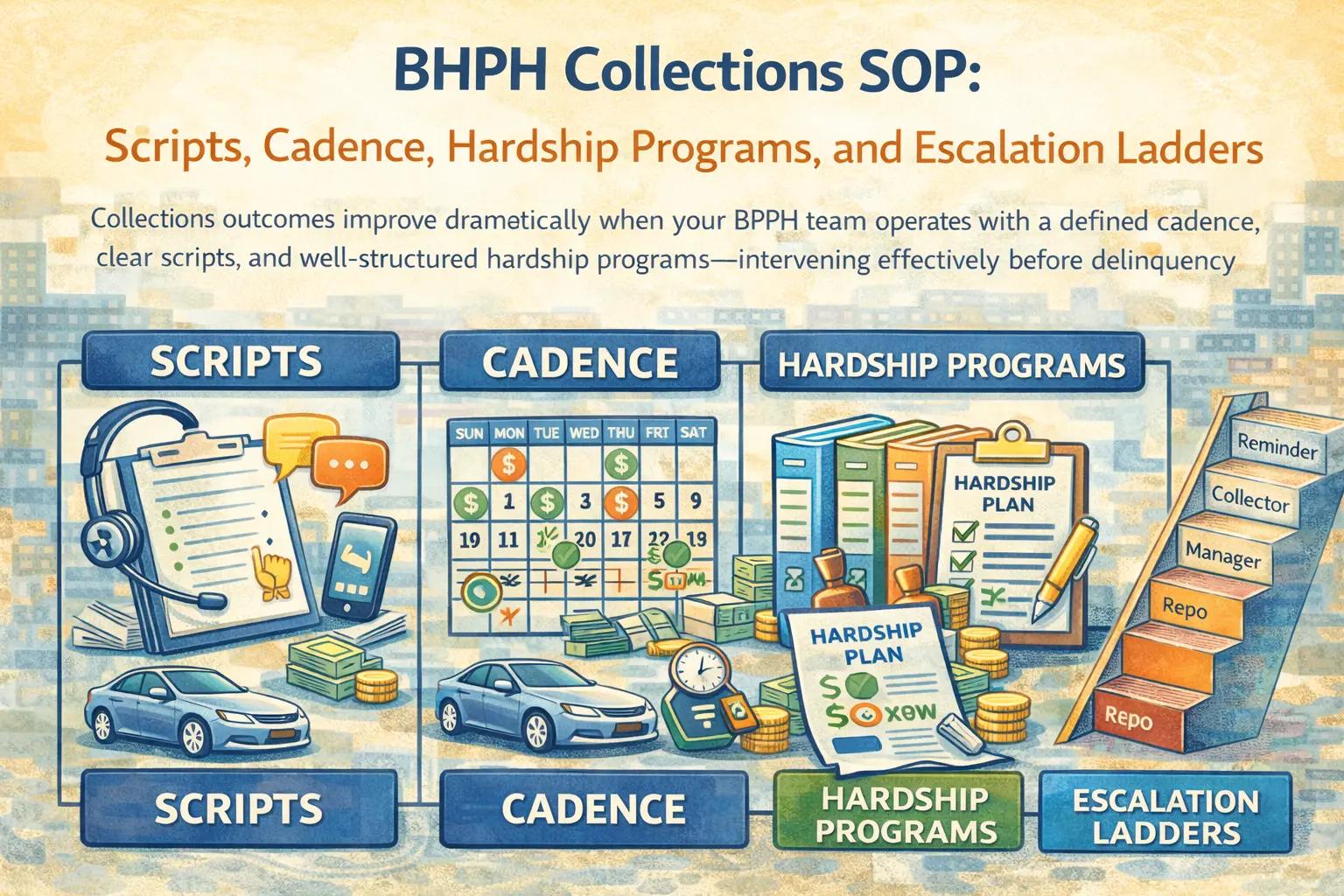

Conclusion: Mastering Collections for Sustainable BHPH Profitability

In the BHPH sector, a robust Collections SOP is not merely a best practice; it is a strategic imperative. By implementing clear scripts, a disciplined communication cadence, and well-defined hardship programs, dealerships can transform reactive collections into a proactive, customer-centric process. This systematic approach effectively reduces delinquency, stabilizes cash flow, and ultimately preserves the profitability of your portfolio, long before a repossession decision becomes necessary. Should repossession become unavoidable, a clear understanding of the BHPH Repossession and Recovery Workflow is paramount for minimizing losses.

Embrace a structured Collections SOP as a cornerstone of your BHPH operations. With a committed team and integrated tools like DealerClick, your dealership can achieve superior collections outcomes, build stronger customer relationships, and secure long-term financial stability.

Ready to transform your BHPH collections with a powerful SOP?

Frequently Asked Questions (FAQs)

Why is speed and consistency important in BHPH collections?

Speed and consistency are crucial in BHPH collections because early intervention significantly increases the likelihood of resolving a missed payment before it escalates. Consistent, polite reminders and follow-ups reinforce payment habits and demonstrate the dealership's professionalism, making it more likely for customers to communicate and resolve issues.

What is a "collections cadence" and how do I build one?

A collections cadence is a predefined sequence and timing of communication and actions taken with a customer from the moment a payment is missed. Building one involves setting specific intervals for automated reminders (SMS, email) and personal outreach (calls), escalating in frequency and urgency as delinquency progresses, and documenting all interactions.

What are "hardship programs" in BHPH collections?

Hardship programs are structured options offered to customers experiencing temporary financial difficulties that prevent them from making their regular payments. These can include short-term payment deferrals, modified payment plans, or interest-only periods. They are designed to help customers get back on track, preventing charge-offs and preserving the account.

How do collections scripts reduce conflict and ensure compliance?

Collections scripts provide standardized language for agents to use during customer interactions. They reduce conflict by ensuring a consistent, empathetic, and problem-solving tone, focusing on resolution rather than accusation. They also ensure compliance by including necessary disclosures and avoiding any language that could violate consumer protection laws.

How can DealerClick improve BHPH collections efficiency?

DealerClick integrates automated payment reminders, allows for detailed logging of all communications and promise-to-pays, and provides real-time visibility into account statuses. Its customizable workflows help enforce collection cadences and scripts, streamlining operations, improving cure rates, and ensuring all actions are documented for compliance and reporting.

Stay Updated

Get the latest auto dealer insights delivered straight to your inbox.

No spam. Unsubscribe anytime.